Financial statements with Breek.gr 2.1 - The Ledger Update

After the recent upgrade of Breek.gr to version 2.0 and as a further improvement of the web application based on …

In the dynamic Greek real-estate market with more and more investors from abroad, real-estate construction and development companies are seeing their turnover grow with enough effort and business risk, so that they can eventually make an profit from the sale of each individual property in their portfolio–if and when the market remains as strong as it was at the beginning of the construction/development/renovation project.

In a growing market, however, the differentiation that each “player” achieves cannot be based indefinitely solely on the quality of the property and on marketing alone so that the property will at some point generate a single “profit event” from its sale. An important factor in the long-term strategy of a company that grows because “the pie is growing” is to gain a larger market share by diversifying the company’s revenue sources with high quality and value-added services for all participants–both for the buyers/investors and for the real-estate developer itself.

This dilemma is already familiar to us from the technology sector: it is a major reason why many companies are now strategically adding other business models to their portfolio in order to grow beyond the profitability constraints of their mature and familiar market. It is one reason why the purchase of a product is increasingly being accompanied by attempts to upsell customers with accompanying services on a subscription-based billing model.

Companies that have over time relied on one-off equipment sales have over time found themselves locked in a battle of impressions for the physical, tangible products they have traded for decades in markets that have now matured and been saturated by competitors at every level of quality and price. Each sale was an event that would be repeated–perhaps–in some years again, either to the same buyer or to new buyers– if and when those buyers had not in the meantime been lured by a competitor who happened (and succeeded) in winning the battle of impressions thanks to fancier marketing, lower prices, or even random factors.

In such a market, any drop in demand creates more and more pressure to adjust prices downwards. New competitors, even of lower quality, gain customers at the expense of incumbents and erode their market share–even if these new contenders are opportunistic, with no intention of serving the market for decades beyond any opportunistic “sales fireworks” at your incumbent company’s expense.

One of the solutions to this dilemma for any established real estate construction and development company is to enhance its offering with accompanying services—services which, with regular, periodic billing of the client, smooth the provider’s cash flow with so-called “sticky revenues”. They are called “sticky”, as they will most likely continue (even partially) even in the times of “skinny cows” in the domestic real-estate market; something that, especially in the real-estate sector in Greece or elsewhere, is not without precedent. In contrast to these “sticky” incomes, incomes from one-off sales can be rather stochastic, isolated, and are therefore called “spiky”: high in amount, few in number and occassional, relative to the lower but recurring income from subscription services.

For developers and real-estate development companies, linking the sale transaction with the conclusion of an agreement for the provision of property management services is an exceptional way to achieve what many innovative foreign giants have already achieved: protect their market share over time from opportunistic attacks, protect their margins by partially decoupling sales prices from the buyer’s impression of the tangible product alone, and even add new sources of income by selling not more of the same, but also new offerings that ride on the successful individual sales of the past, even if these sales happened a long time ago.

If you want a concrete example: this is why Apple has been supporting every iPhone model for almost a decade now, but has managed not only not to lower the selling prices of the devices, but to increase them substantially. Each device sale is a vector of opportunity to sell additional subscription services that leverage the device so that it stays useful for longer, at a time when the market for new smartphone devices is saturated, our enthusiasm for the iPhone N+1 is now practically zero, and most of us change phones every 4-5 years instead of every 2-3 that we used to in the past. Think of all the iCloud services with which you can store as many photos and videos as you want for years without worrying if, where and how the files are stored–even if your iPhone “only” has 32 GB of storage because you bought it many years ago. Indeed, Apple’s “profit center” of services has grown to become gigantic in recent years, and has for years now been a huge source of profitability for the company.

So why would a business-savvy real-estate construction/development/renovation company with a strategy of long-term market presence stop at building/renovating and selling the properties and thus be content with the “spiky revenues” that these one-off sales events bring in? Why leave the “sticky”, regular profitability from property management services to third parties, especially when a real-estate developer in the unique position of being present within the “universe” of the property from the very first moment of its creation? Indeed, as we shall see, there is no good reason. Providing property management services is not merely a good idea for companies in this industry; it may well be the best idea.

But let’s see: what is property management after all? What services can it include? And, most importantly: why is it a unique growth opportunity especially for real-estate developers?

For a real estate construction and development company that is already successfully facing the organizational challenges of coordinating the execution of its construction, renovation and marketing projects, property management is significantly easier than the technically and organizationally demanding construction/renovation activity, but also easier than the activity of finding investors/buyers and conducting sales at a good margin. Nevertheless, it would be unfair and frivolous not to recognise that property management in itself is also demanding, but in a different way.

This business activity too has its challenges so that it is not just incidental and sloppily executed in a “by the way” manner. Only if done seriously and professionally can property management be a meaningful argument that will “lock in” the client’s decision to prefer the company for real-estate investment. Property management requires organizational capabilities for its execution and diligence and promptness in communicating with all stakeholders (owners, tenants, suppliers and service providers). Only in this way can it contribute to the enhancement of the manager’s business/professional brand and the growth of the turnover of the business model with profitability and not just be a marketing expense incurred haphazardly and in vague hopes of promoting property sales.

Property management encompasses a wide range of services related to value retention, property utilization, the overall operation of a property and its infrastructure, and the management and documentation of all events in a property’s lifecycle. These services allow the owner to sleep soundly regarding the productivity and maintenance of the value of their investment, especially if they are an overseas investor and do not use the property themselves for the majority of the year.

Depending on the range of property management services that the company undertakes to offer to the buyer, there is little to substantial overlap with the activities of a real-estate agent or a provider of facilities management services. For example, a fairly comprehensive range of property management services may include:

In all this, if the management concerns a group of properties (such as a building or a complex), the calculation, collection and payment of common charges (communal or shared expenses) is only a footnote. Property management is neither the “channel management” that has become popular with the onslaught of short-term leases in our country, nor is it purely facilities management–nor is it the (undifferentiated and simplistic) management of communal expenses. Property management is clearly a spectrum of services from which each management company strategically selects a subset to provide, depending on its strategy and sophistication. The criterion for this selection is to provide substantial value to the property owner, and to capture its share of value based on the quality of the performance of the subset of services it is capable of providing in a serious and efficient manner.

The above examples of management services do not require the property manager to be in the business of real-estate construction and development. However, for those who have the comparative advantage of being involved in the property’s history from the first line an architect will draw in AutoCAD, there are significant and unique advantages to providing property management services from the moment the idea for a new or to-be-renovated property is born.

In particular, properties that have been managed from their inception are characterized from the earliest moment with data that other managers (non-builders/renovators or developers) have to collect and digitalize after-the-fact , without having thorough knowledge of their essence, and often while being unaware of their accuracy and completeness. Unlike the latter, a real estate constructor / property developer is in the unique position not only to enrich the property’s file with information and events that arise from the beginning, but also to document the timing, scheduling, events, and outcome of work and transactions that take place from the property’s “t = 0” moment. As an example, let us present the first and historical member of Breek.gr , KAMAI GROUP , a forward-thinking real-estate development company that uses Breek.gr to lay the foundation of management services for the properties it develops, as well as those it renovates and resells:

This way, when the project concludes and property passes from the developer to the investor, the new owner can continue to monitor the property’s status, as the developer actively manages it. The creation of a digital property folder on Breek.gr during the construction project thus contributes to a smooth transition from spiky to sticky revenues for the development company.

From this point there are other benefits for the property developer, some of which are short-term, some long-term, and some of which contribute indirectly to developing the company’s brand and maintaining and strengthening its relationship with the buyer. All of this is the result of active and competent digital property management with Breek.gr. In particular: thanks to the immediacy and traceability that Breek.gr makes possible.

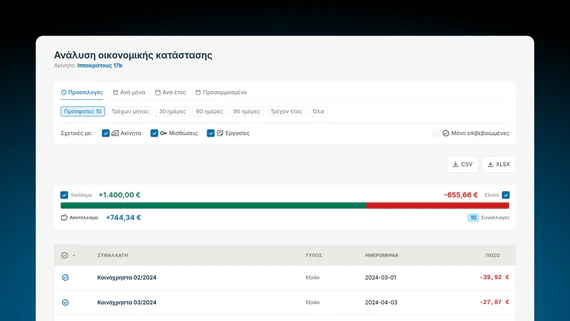

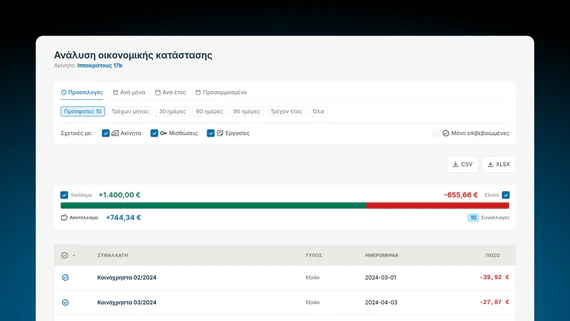

As a registered member of Breek.gr, every investor/owner of a property that KAMAI GROUP develops, gains access to the digital folder of the property. Thus, he has access to all the data that characterize and document the property–from anywhere, whenever he wants and in any way he wants (from a mobile phone, tablet, or laptop or desktop PC). At the same time, every update of the records (leases, financials, tasks, documents, etc.) by KAMAI GROUP’s property manager automatically generates notifications to the owner for every event concerning the property, and every information that enriches the property’s digital folder on Breek.gr.

This way, both the owner knows at any time and at will what is happening with his investment , and the property manager is spared the trouble of sending updates to the owner by emails with attachments resulting from scattered files. KAMAI GROUP is thus able to charge the owner a fee for the management of the property. The value of the subscription to its services obviously exceeds the total cost of providing them; i.e.: the “fully loaded” labour costs, plus the comparatively meagre Breek.gr monthly subscription per property (or per user ).

The result? Profitability for the real-estate developer not only from the single “spiky revenue” of the property sale transaction, but also from the regular “sticky revenues” of the provision of digitized property management services over longer time periods. Besides, the investors in KAMAI GROUP’s properties are practically exclusively foreign investors in real estate in Greece. Thus, the concept of property management is already familiar to most of them, the usefulness of such services makes them indispensable for them, and the digital way in which they enjoy the property management services’ “fruits” through Breek.gr is welcome to them and not just “modern” and “digital” but practically useful. Property management is therefore not just an eye-catching fancy marketing effect for investors/owners, but also an essential service for which they are willing to pay a subscription fee.

In short: the owners/investors reap benefits and the property developer upgrades their brand towards these customers, creating fertile ground for further investment or recommendation to other investors. The company that offers accompanying management services thus manages to become “top of mind” to its clients, as frequent updates through Breek.gr remind them of the real estate developer they once chose for their investment–even many years after the purchase/investment took place.

In addition to these benefits, which are relatively immediate and tangible (due to the tangible revenues from the owner’s subscription to management services), there are other benefits, which occur over time:

With each new record and its correlation to the property and other records on Breek.gr, the burden of managing a property for the property manager is reduced further. Each key piece of information is “one click away”. The property manager can therefore increasingly overcome the entropy of “scatter” , thanks to the associations already made between owners, tenancies/occupancies, tasks, financials transactions and contacts.

With each new record and its correlation to the property and other records, the amount of information that characterizes the property increases, creating a clear track record of a) its economic performance (what rental income it is capable of generating, and what expenses are anticipated to maintain its value so that it can be rented at a good price), and b) the operations that the property has experienced, including exactly what was done, how, by whom, and how much it cost.

Therefore, a property that has its own digital folder on Breek.gr with a rich and reliable history is a dramatically better-documented item for resale in the future: it is not a “pig in a poke” . The information within the property’s digital folder and the associated records (tenancies, transactions, tasks, contacts, equipment/inventory, attached documents) demonstrates investment in maintaining its value and indicate the economic outcome a buyer could expect from it, based on its documented history. That is: a property with a diligently enriched digital folder on Breek.gr reduces the risk of investment for the buyer, and therefore has a different (higher) value than the same property without a digital folder enriched through active management. How much greater? We leave that to you and your negotiating skills as a landlord! But, surely, it is better for the buyer to be able to identify the value of the property they are about to buy than not, and thus you avoid negotiating the price only through direct comparability to other investments’ “specifications”.

The same applies to the real-estate developer: a property that is made available for the first time on the market accompanied by a complete digital folder documenting with photographs and attachments the most important work from the first step of the project or the first excavation, is certainly more interesting than the same property, but without the accompanying digital information–and in this case, this advantage is not only informative for the buyer and monetarily tangible for the owner, but informative for the investor and monetarily tangible for the owner. As long as your competition has nothing to offer in the way of providing management services digitally, that leaves price negotiation as the only weapon to get the buyer to prefer your competitor, rather than you, for their investment.

Or, put differently: “why if you build, develop or renovate properties, providing property management services is the logical conclusion for the strategic growth of your company”.

In a market that is growing with investment inflows from abroad, but also a market with “ups and downs” and price wars instigated by short-termist, opportunistic competitors, the growth of a property construction/development/renovation company cannot forever be based solely on the purchase and (re-)sale of properties. Incorporating new, complementary business models is a one-way street both to deal with competitors with minimized margin erosion and to continually expand the client base for future projects.

The provision of property management services is the most affordable and plausible new business model for such a company, as it leverages unique information assets that the developer has in terms of information about the property from the concept stage. This is information that pure-play realtors and pure-play property managers de facto cannot have or know to the same degree of quality, as these players become involved with the property long after it was built; any information they manage is at best second-hand, and at worse incomplete or erroneous.

Traditionally, the operations for providing such services have been complicated and time-consuming, filled with rummaging through notes, papers, notebooks, scrapbooks, folders, inboxes, emails, attachments, hard drives and lockers. There are more than a few real estate agents and property managers in the marketplace who have found their way and accept the effort it entails, as it is familiar to them–even if it is not functionally satisfactory for their clients, or efficient for their own business. However, by using digital tools like Breek.gr, companies can expand their property-as-a-product income streams from individual sales to recurring and therefore predictable cash flows. Digital property management offers multiple benefits, including improved organization, easy access to data, and traceable management processes. The result is the ability to seriously manage way more properties with less manpower. The predictable consequence of doing so is increased profitability for the property-management profit center itself and for the real estate construction/development company–especially over longer time periods.

Through this online application developed with the needs of its members in mind, industry professionals can efficiently manage every aspect of a project, from maintenance and renovations to renting and selling, and obviously everything else that happens in between, during the useful life of the property. Breek.gr serves as the ideal environment on which implement this business model, allowing real estate construction/development companies to increase their efficiency, improve the execution of management services, strengthen their market position, and ultimately a) remain in the minds of their clients, b) become the first recommendation to their acquaintances thanks to a modern and efficient management system, and c) (why not?) add new sources of income and grow their revenues profitably.

As it is obvious, the use of digital tools such as Breek.gr (the only property management software in Greece, made in Greece, and for the Greek market) offers multiple benefits for investors/owners, property developers and their clients. Some of them:

In summary, the adoption of digital solutions for property management is a logical and effective step for the growth of both property owners and property development companies. Any business owner in the industry with aspirations to grow their company’s revenues with profitable services, and with a full understanding of the waves of change and adaptation that occur in the industry every so many years, can act strategically to expand their company’s business model portfolio with services that leverage their company’s unique assets and are affordable to organize and execute.

Are you interested to see how Breek.gr can make you a business pioneer in your industry? Book an online demo now or contact our team on LinkedIn or email hello@breek.gr ! Did you sign up and see something you’re missing? We are happy to receive your feedback, analyze your requirements, and prioritize improvements to develop the app to meet your needs.

After the recent upgrade of Breek.gr to version 2.0 and as a further improvement of the web application based on …

I am very pleased to announce that version 2.0 of Breek.gr is now available for everyone! Version 2.0 is an expected but …

With your new user account on Breek.gr you can create and manage five properties for free, one of which with the full functionality of the Monitor tier. Test-drive Breek.gr now and experience first-hand how it makes property management a breeze!